OPTEX GROUP is keenly aware that our greatest mission is to continuously enhance our corporate values while acquiring the trust of our shareholders, and investors as well as our customers and society. In order to realize this, OPTEX GROUP is committed to maintaining its management system and strengthening the management monitoring functions which enable the promotion of management transparency and fair and immediate decision making, positioning the fulfillment of corporate governance as one of our most significant challenges for management.

Shareholders Meeting

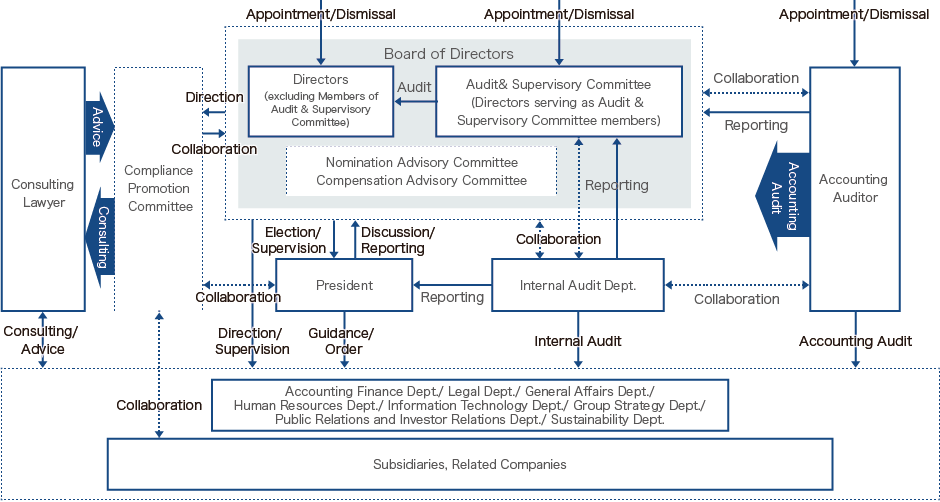

Organizational Composition and Operation

-

Organization Form

-

Company with Audit & Supervisory Committee

Directors

-

Maximum Number of Directors Stipulated in Articles of Incorporation

-

13

-

Term of Office Stipulated in Articles of Incorporation

-

One year

-

Chairperson of the Board

-

President

-

Number of Directors

-

8

-

Nomination of Outside Directors

-

Nominated

-

Number of Outside Directors

-

4

-

Number of Independent Outside Directors

-

4

Number of Independent Outside Directors

- Name

- Kazuhiro Yoshida

- Membership of Supervisory Committee

- -

- Designation as Independent Director

- ○

- Reasons for Appointment

- Mr. Yoshida worked at a major Japanese electronics manufacturer as an engineer for many years. He was also head of the general affairs and human resources division and of the management planning division and an executive officer at the company and served as a director at an affiliate of the company. He has extensive experience and knowledge.

The Company has determined that he is suitable as a Director of the Company and has appointed him as an Outside Director to continue to enhance the Group’s corporate value.

The Company has designated Mr. Yoshida as an Independent Officer because he does not come under an executing person, etc. of the Company, the Group or major business partners and because it has been concluded that he is unlikely to cause any conflicts of interest with general shareholders in light of the criteria for independence established by the Exchange and the Company.

- Name

- Shoko Negishi

- Membership of Supervisory Committee

- -

- Designation as Independent Director

- ○

- Reasons for Appointment

-

Ms. Negishi worked as an economist at the World Bank’s Research Group. Her research focused on international finance not only in developed economies such as Japan but also in developing and emerging economies. She has a global perspective and extensive practical experience and knowledge as well as insight in her area of expertise. The Company has determined that she is suitable as a Director of the Company and has appointed her as an Outside Director, expecting her to give the Company appropriate advice to further strengthen corporate governance and to continue to enhance its corporate value.

The Company has designated Ms. Negishi as an Independent Officer because she does not come under an executing person, etc. of the Company, the Group or major business partners and because it has been concluded that she is unlikely to cause any conflicts of interest with general shareholders in light of the criteria for independence established by the Exchange and the Company.

- Name

- Minoru Kida

- Membership of Supervisory Committee

- ○

- Designation as Independent Director

- ○

- Reasons for Appointment

-

Mr. Kida has a wide range of insight and extensive knowledge and experience, including his involvement in auditing listed companies as a certified public accountant and a certified tax accountant for many years. The Company has determined that he is able to further strengthen the audit system of the Group by giving accurate advice and appointed him as an Outside Director who is a member of the Audit & Supervisory Committee.

The Company has designated Mr. Kida as an Independent Officer because he does not come under an executing person, etc. of the Company, the Group or major business partners and because it has been concluded that he is unlikely to cause any conflicts of interest with general shareholders in light of the criteria for independence established by the Exchange and the Company.

- Name

- Keiko Iijima

- Membership of Supervisory Committee

- ○

- Designation as Independent Director

- ○

- Reasons for Appointment

-

Ms. Iijima has a wide range of insight and extensive knowledge and experience, including her involvement in serving as a Director and a Corporate Auditor through corporate legal affairs as a lawyer in listed companies for many years. The Company has determined that she is able to further strengthen the audit system of the Group by giving accurate advice and appointed her as an Outside Director who is a member of the Audit & Supervisory Committee.

The Company has designated Ms. Iijima as an Independent Officer because she does not come under an executing person, etc. of the Company, the Group or major business partners and because it has been concluded that she is unlikely to cause any conflicts of interest with general shareholders in light of the criteria for independence established by the Exchange and the Company.

Audit & Supervisory Committee

Committee’s Composition and Attributes of Chairperson

-

- Audit & Supervisory Committee

- All Committee Members

- 3

- Full-time Members

- 1

- Inside Directors

- 1

- Outside Directors

- 2

- Chairperson

- Full-time

Directors

Voluntary Establishment of Nomination/Compensation Committee

Committee’s Name, Composition, and Attributes of Chairperson

- Committee Corresponding to Nomination Committee

- Committee’s Name

- Nomination Advisory Committee

- All Committee Members

- 3

- Full-time Members

- 0

- Inside Directors

- 1

- Outside Directors

- 2

- Outside Experts

- 0

- Other

- 0

- Chairperson

- Outside Directors

- Committee Corresponding to Compensation Committee

- Committee’s Name

- Compensation Advisory Committee

- All Committee Members

- 3

- Full-time Members

- 0

- Inside Directors

- 1

- Outside Directors

- 2

- Outside Experts

- 0

- Other

- 0

- Chairperson

- Outside Directors

Policy, etc. on determination of details of officers’ remuneration, etc

At a meeting of the Board of Directors held on February 12, 2021, the Board resolved to adopt the policy on determining remuneration etc. for individual Directors. Subsequently, at a meeting of the Board of Directors held on March 24, 2023, a new resolution was adopted to partially revise the content of this policy.

An outline of the policy for determining the content of remuneration, etc. for individual Directors is as follows.

1. Basic policy

The remuneration of Directors (excluding Directors who are members of the Audit & Supervisory Committee) shall consist of base remuneration, which is fixed compensation, and stock-based compensation (stock options, etc.) for the purpose of providing an incentive to contribute to the sustainable improvement of the Company’s business performance and corporate value from mid- and long-term perspective and promoting value sharing with shareholders. The ratio of each shall be set based on comprehensive consideration of a variety of factors such as ability and responsibilities.

The remuneration of Directors who are members of the Audit & Supervisory Committee shall be within the total amount of remuneration approved by resolution of the general shareholders meeting and shall be composed of only base remuneration, which fixed compensation, in light of their role in the supervision of management in general.

2. Policy for determining the amount of basic remuneration (monetary remuneration) for individual Directors (including the policy for determining the time or conditions for giving remuneration, etc.)

The base remuneration of Directors shall be determined in accordance with specific standards, taking into consideration factors such as each Director’s position and duties, the management environment and operating performance. The annual amount shall be determined in March each year, divided into 12 equal amounts (excluding the portion for stock-based compensation with restrictions on transfer) and paid in cash every month from the next April until March the following year.

3. Policy for determining the method for calculating the content, amount and number of non-monetary rewards (including a policy for determining when these rewards are provided and the conditions for providing them)

For the purpose of promoting value sharing between the subject Directors (excludes Directors who are members of the Audit & Supervisory Committee and Outside Directors) and shareholders, part of the base remuneration paid every month shall be granted in the form of stock-based compensation with restrictions on transfer in accordance with the Rules on Stock-based Compensation with Restrictions on Transfer. In the event of significant fluctuation in operating performance, etc., the annual salary of Directors may be reduced by reducing the part granted in the form of stock-based compensation with restrictions on transfer.

Stock options shall be granted for the purpose of providing incentives to contribute to the sustainable increase of the Company’s corporate value from long-term perspective, increase motivation and promote value sharing with shareholders. Stock acquisition rights as stock options shall be provided according to standards established by duty position, etc. in accordance with the Rules on Stock Options.

4. Policy for determining the ratios of the amount of monetary remuneration and the amount of non-monetary remuneration for individual Directors

The Compensation Advisory Committee (chaired by Independent Outside Director), which consists of three Directors, including two Independent Outside Directors, shall make a report to the Board of Directors on the remuneration of Directors, based on comprehensive consideration of the composition of remuneration, system design and the content of remuneration, etc. for individual Directors. The remuneration of Directors (excluding Directors who are members of the Audit & Supervisory Committee) shall then be determined by the Board of Directors, and the remuneration of Directors who are members of the Audit & Supervisory Committee shall be determined through consultation by the Audit & Supervisory Committee.

5. Matters concerning the determination of the content of remuneration, etc. for individual Directors

Specific details of the amount of compensation for each individual Director (excluding Directors who are members of the Audit & Supervisory Committee) shall be delegated to the President and Representative Director, based on a resolution of the Board of Directors, and the content of the delegated authority shall be the amount of base remuneration for each director (excluding Directors who are members of the Audit & Supervisory Committee). To ensure that such authority is appropriately exercised by the President and Representative Director, the Board of Directors shall obtain a report from the Compensation Advisory Committee on a submitted draft proposal, and the President and Representative Director subject to the above-mentioned delegation shall determine the details of the compensation according to the content of said report. For stock compensation, the number of allotted shares for individual Directors shall be determined by the Board of Directors in light of the report of the Compensation Advisory Committee.

Evaluation of the effectiveness of the Board of Directors

To further enhance the effectiveness of the Board of Directors, the Company conducts a questionnaire once a year targeting all Directors, and the Board analyzes and evaluates the results through constructive discussions. The results of a questionnaire survey conducted in February this year (8 Directors, 100% response rate) show that the Board of Directors of the Company is evaluated as largely fulfilling its roles and responsibilities effectively. Meanwhile, the members of the Board of Directors share the recognition that spending more time than ever before on substantive discussion of important matters such as management strategy and M&A will further improve functionality. We will work to make improvements in those matters and continue to ensure and strengthen the effectiveness of the Board of Directors.