The Optex Group recognizes the risks and opportunities related to climate change, including global warming, as important management issues, and in January 2023, we expressed our support for the Task Force on Climate-related Financial Disclosure (TCFD)*. We will further promote information disclosure on items including "Governance," "Strategy," "Risk Management," and “Metrics and Targets" based on the TCFD framework, as well as contribute to the realization of a sustainable society and provide new value through our business activities.

※The Task Force on Climate-related Financial Disclosures (TCFD):

At the request of the G20, the Financial Stability Board (FSB), the body responsible for oversight of international finance, established this task force in 2015. In its final report published in June 2017, the TCFD recommends disclosure of climate change-related information from companies to investors and recommends a framework for such disclosure.

Governance

Optex Group has established the Compliance Promotion Committee, chaired by the President and Representative Director and meeting at least twice a year, as an organization under the direct control of the Board of Directors to discuss important sustainability issues, including climate change risk. The Committee submits its deliberations to the Board of Directors, which deliberates on the issues and then disseminates them to all Group companies.

In addition to expressing its endorsement of the TCFD, the committee has formed a "Climate Change Response Subcommittee" as a subordinate organization of the Group Compliance Promotion Committee, which was formed in 2023. The Subcommittee's policy is to fulfill its corporate social responsibility by measuring greenhouse gases, studying and implementing reduction measures through the use of renewable energy, and disclosing information based on the TCFD framework.

In addition, from 2024, we established a Sustainability Support Division to concretely define our Group's emissions reduction plan, and Optex Group Headquarters is taking the lead in testing reduction proposals to ensure that the entire Group achieves its plan.

We will continue to strengthen its monitoring function for efforts across the entire Group to further enhance the effectiveness of our sustainability activities, including our response to climate change.

Strategy

The circumstances surrounding the Group's business are changing markedly, including the acceleration of global carbon pricing in response to climate change, which is becoming more serious every year, growing interest in renewable energy, the shift to electric vehicles (EVs), etc., and responding to these changes is an urgent task.

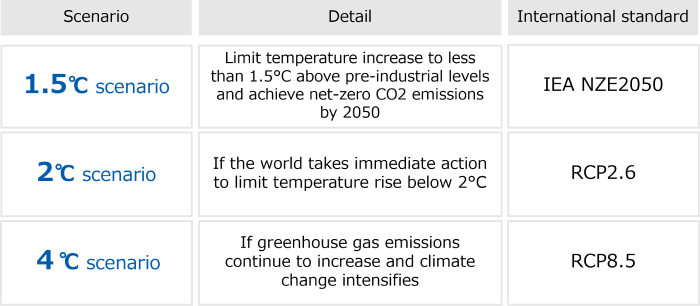

In order to predict the impact of the above external changes on our business from various perspectives, our Group has examined the business risks, opportunities, and countermeasures that could be assumed under each scenario with reference to the risk scenarios in the international standards. Specifically, we selected three scenarios: 1.5°C scenario, 2°C scenario, and 4°C scenario. Details of each scenario and the international standards used in each scenario analysis are listed in the table below.

Risks and Opportunities

We have identified potential risks and opportunities for each of our Group companies in Japan and overseas, in line with the "Risks and Opportunities" section of the CDP Climate Change Questionnaire, one of the international standards for environmental information disclosure.

The main contents, including the potential financial impact and the cost of responding to risks and realizing opportunities, were calculated and categorized into short-term (1-3 years), medium-term (3-9 years), and long-term (more than 9 years) plans.

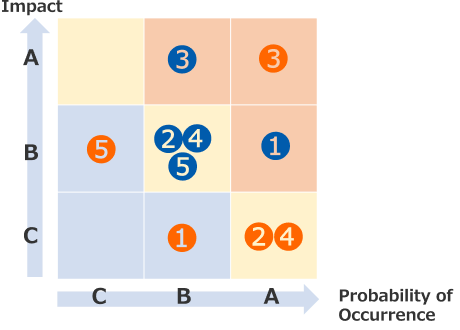

In addition, the probability of occurrence and impact of each event were evaluated on a 3-point scale, and these two scores were multiplied to calculate the importance of the event on a 3-point scale of major, medium, and minor. Based on the importance of each event, the Group considered measures to address each risk and opportunity.

The main risks, opportunities, and countermeasures are summarized in the table below.

Main Risk

Responses

Importance

1

Increase in overhead costs due to accelerated switchover to renewable energy sources

- ・Calculation of greenhouse gas emissions and promotion of reduction activities

- ・Switching some company vehicles to HV/PHEV/BEV

- ・Energy saving of office lighting

2

Increased costs of components and raw materials due to introduction of carbon tax

- ・Expand the ratio of renewable energy use throughout the supply chain through mutual cooperation with suppliers and customers

- ・Reduce manufacturing costs through systematic design changes in preparation for rising costs of raw materials.

3

Disapproval from stakeholders and consumers due to lack of environmental initiatives and appeal

- ・Active promotion of climate change response and external communication (information disclosure based on TCFD recommendations, reflection of implementation details in CDP Climate Change Questionnaire, etc.)

- ・Establishment of CO2 reduction targets and promotion of initiatives

4

Increased risk of heat stroke due to increased number of extremely hot days

- ・Improvement of air conditioning facilities in offices and production sites

- ・Installation of water supply units at environmental experience learning facilities

5

Shutdown of the company's own plants due to natural disasters, disruption of employee access

- ・Reinforcement of BCP measures, waterproofing

- ・Decentralization of production bases

Main Opportunities

Responses

Importance

1

Growing demand for low carbon emission products

- ・Promote development, sales, and services of environmentally friendly products (automatic door sensors that consider air conditioning efficiency, AI-based visual inspection solutions, industrial sensors that contribute to automation)

2

Accelerated demand for energy-saving products

- ・Development and sales enhancement of products that are lighter in weight and consume less power

- ・Expand sales of high-performance products that lead to improved productivity

3

Entering new markets through increased demand for EV batteries

- ・Introduce new products to the EV market

- ・Expand sales of EV battery manufacturing equipment

4

Growing demand for high-accuracy inspections due to increased demand for renewable energy products (solar panels, EV batteries, etc.)

- ・Expand sales of sensors for factory automation and LED lighting for image inspection

5

Increased demand related to disaster prevention measures due to chronic heavy rainfall

- ・Develop and expand sales of flood monitoring systems, predictive disaster maintenance systems, robots for disaster inspection, etc.

Importance of Risks and Opportunities

Based on the probability of occurrence and impact of an event, we rated the importance of the event on a scale of major, medium, and minor, which is reflected in the map on the right.

Risk Management

Under the management and supervision of the Board of Directors, Optex Group has established the Group Compliance Promotion Committee, chaired by the President and CEO, as the Group's cross-sectional risk management structure to promote and oversee risk management related to business operations, including climate-related risks.

At least twice a year, the Group Compliance Promotion Committee identifies and assesses risks and conducts a comprehensive review of risk management as necessary. The identified risks and evaluation results are clearly indicated in a "Risk Map" and are disseminated to all Group companies after consulting with the Board of Directors in conjunction with the response policy.

Metrics and Targets

The Group has set a mid to long-term goal of reducing CO2 emissions (Scope 1 and 2) by 30% or more (compared to FY 2019) by FY 2030. To achieve this goal, we are working to reduce emissions by reviewing our own facilities and operations, including efforts to improve employee understanding and awareness.

In addition, in response to the government-announced policy of carbon neutrality by 2050, we will continue to study reduction plans to achieve virtually zero greenhouse gas emissions for the entire Group.

CO2 Emissions (Scope1+2)

Supplemental: Scope 3 Initiatives

Optex Group provides environmentally friendly products and believes that we can make a significant contribution to the reduction of greenhouse gases through the corporate activities of our customers who adopt our products.

Details of our efforts to reduce environmental impact can be found at the following link.